Manufacturing industry

2025

En 2025, el PBI manufacturero registró un ligero crecimiento de 2.7% con respecto al año 2024, impulsado por el significativo incremento de la manufactura primaria (+4.9%). Así también, contribuyó al desempeño positivo la manufactura no primaria (+1.9%), favorecida por la recuperación de la demanda local (5.4%) y el importante crecimiento de las exportaciones industriales (+14.5%).

01

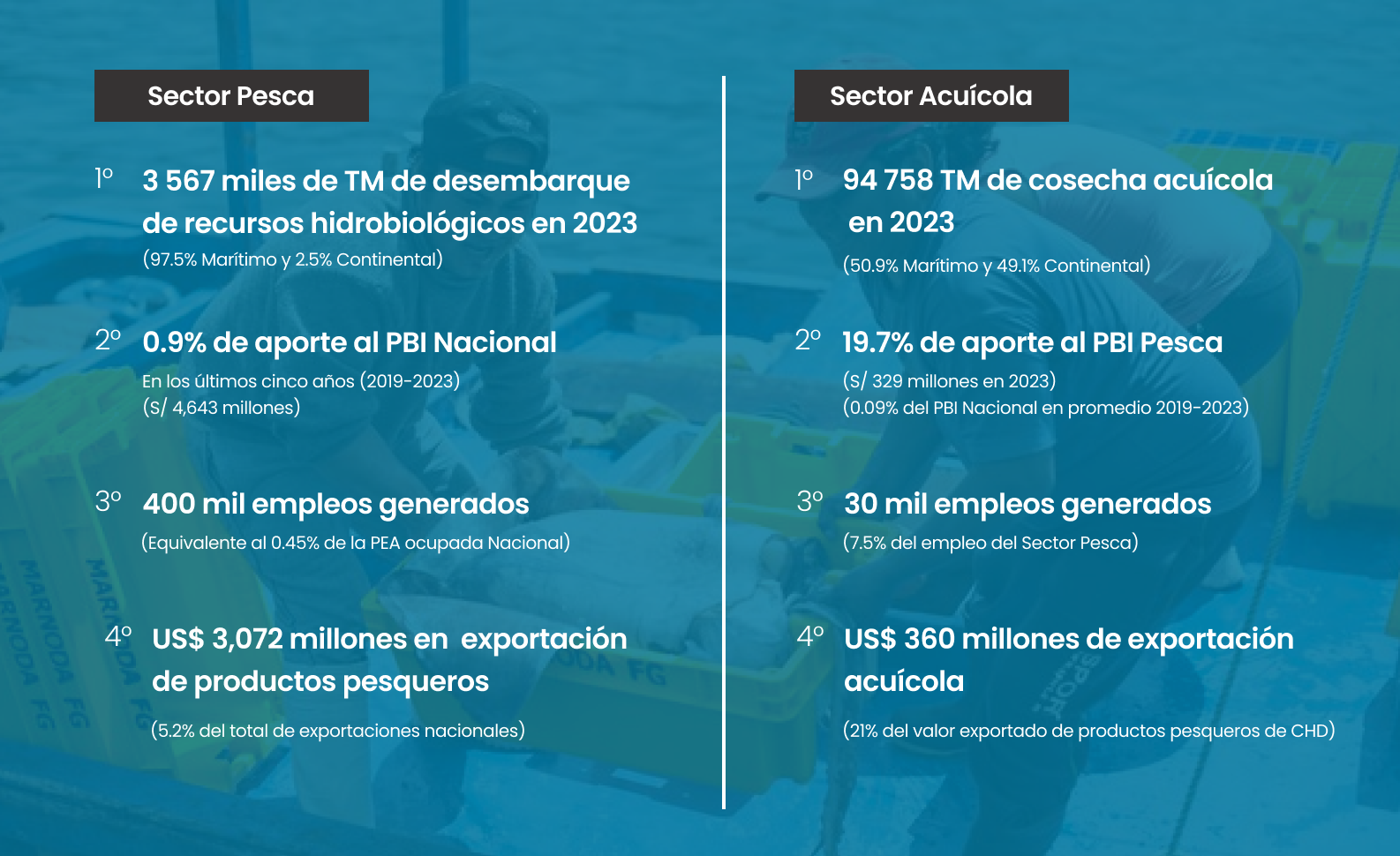

Fishing Sector

2025

En 2025, el PBI del sector pesquero registró un crecimiento de 2.9% respecto al año anterior, impulsado principalmente por el incremento en la captura de los recursos destinados para el CHD - Consumo Humano Directo (congelado). Los desembarques ascendieron a un total de 6,206.8 miles de toneladas, lo que representa un moderado crecimiento de 6.7%enrelacióna lo registrado el 2024 (5,818.6miles de TM)

02

Aquaculture

october 2025

In October 2025, aquaculture harvests reached 10,726 metric tons (MT), a year-on-year decrease of 24.0% compared to 14,091 MT. This result was mainly due to a reduction in the harvest of trout (−62.6%), tilapia (−31.8%), and scallops (−16.1%).

03

Domestic Trade

2025

En el 2025, las ventas del sector comercio interno crecieron 5.2% con respecto al año 2024. Este resultado fue impulsado por el importante crecimiento de la demanda interna (+5,8%), favorecido por campañas estratégicas de ventas en línea, el mayor consumo de productos básicos y el dinamismo del sector construcción.

04

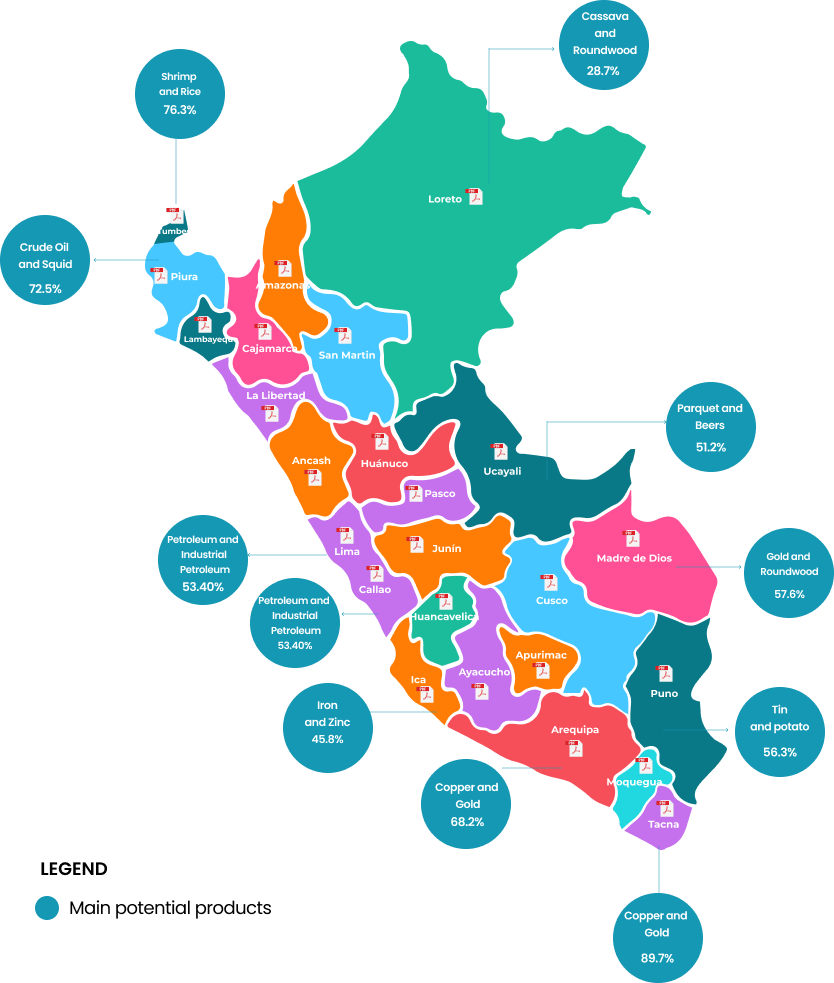

Sectoral Studies

These sectoral studies analyze the performance of an industry at an economic and statistical level, evaluating key indicators such as GDP, employment, and innovation. They are essential for strategic decision-making and the design of policies that promote sectoral growth. We invite you to review them!

05

Current Information

Fishing Data

30% cayó el precio del Bonito

(4.5 soles x Kg). En 2023 récord histórico de captura de Bonito (116 815 toneladas)

Fishing Data

Access information on prices and volumes of the main species for each region.

Business Productivity

4.6% and 27.1% represent the productivity of micro and small enterprises compared to large enterprises, respectively.

Business Informality

84.8% represents the level of labor informality in MSEs 91.3% asciende la Informalidad en las Microempresas a nivel nacional

Business Informality

Access the most comprehensive analysis of business informality in Peru.

Wholesale and Food Markets

2612 wholesale and food markets in Peru. 318 of them are located in rural areas.

Wholesale and Food Markets

Wholesale and Food markets are at the core of supplying essential products. Check their main characteristics based on the Wholesale Markets Census.

Convenience Stores

There are more than 590,000 convenience stores in the country. Lima accounts for 45% of the total.

Convenience Stores

Accede a información más relevante sobre el estado de las bodegas y además, ubica que te quede más cerca

Cooperatives

1245 Cooperatives are registered in Peru.

The cooperative membership population in the country totals 2.4 million individuals

Cooperatives

Up-to-date information about the world of cooperatives: discover who they are, where they are located, what they do, how many members they have, and how many workers they employ.

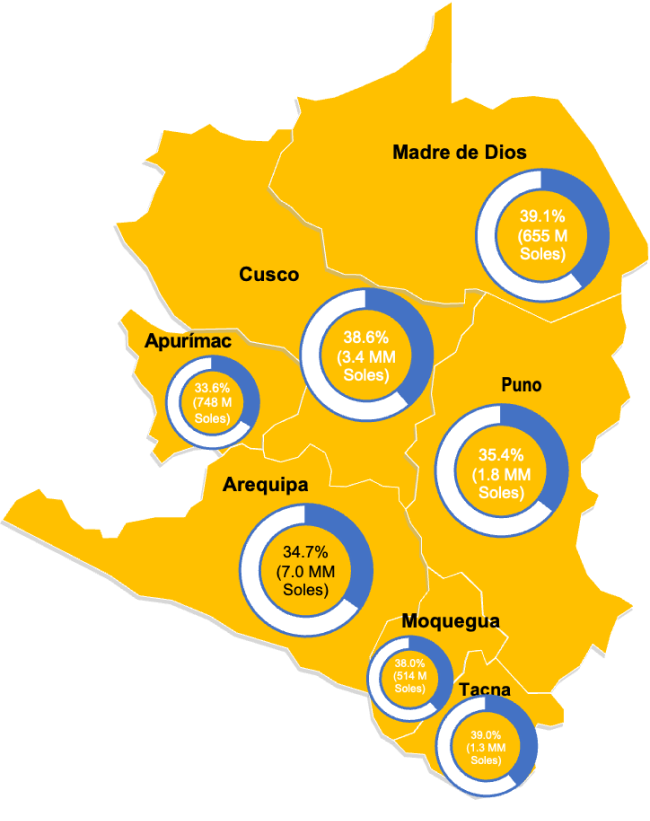

01. MSMEs in numbers

Micro, small and medium-sized enterprises (MSMEs) account for 99.4% of the business sector in Peru. These enterprises are not only a crucial component of the business structure but also make a significant contribution to the Gross Domestic Product (GDP), accounting for 21% a la riqueza nacional. Las Mipyme emplean el 61,4% of the Economically Active Population, underscoring their economic significance and establishing them as one of the principal drivers of employment in the country.

03. Top Sectors of the Export Manufacturing Industry

| Top | Company | % Share of Exports |

|---|---|---|

| 1 | NEXA RESOURCES CAJAMARQUILLA S.A. | 39.2% |

| 2 | PROCESADORA SUDAMERICANA S.R.L. | 18.1% |

| 3 | TECNOFIL S.A. | 13.5% |

| 4 | CORPORACION ACEROS AREQUIPA S.A. | 6.8% |

| 5 | INDUSTRIAS ELECTRO QUIMICAS S.A. | 5.6% |

| Top | Enterprises | % Share of Exports |

|---|---|---|

| 1 | TECNOLOGICA DE ALIMENTOS S.A. | 8.0% |

| 2 | PESQUERA EXALMAR S.A.A. | 5.7% |

| 3 | VIRU S.A. | 4.2% |

| 4 | VITAPRO S.A. | 3.9% |

| 5 | DANPER TRUJILLO S.A.C. | 3.7% |

| Top | Enterprises | % Share of Exports |

|---|---|---|

| 1 | QUIMPAC S.A. | 18.3% |

| 2 | SUCROALCOLERA DEL CHIRA S.A. | 6.7% |

| 3 | AGROAURORA S.A.C. | 6.2% |

| 4 | SUDAMERICANA DE FIBRAS S.A. | 5.9% |

| 5 | FAMESA EXPLOSIVOS S.A.C. | 4.9% |

| Top | Enterprises | % Share of Exports |

|---|---|---|

| 1 | MICHELL Y CIA S.A. | 12.9% |

| 2 | TEXTILES CAMONES S.A. | 12.1% |

| 3 | TEXTIL DEL VALLE S.A. | 11.9% |

| 4 | HILANDERIA DE ALGODON PERUANO S.A. | 10.4% |

| 5 | INCA TOPS S.A. | 7.0% |

| Top | Enterprises | % Share of Exports |

|---|---|---|

| 1 | OPP FILM S.A. | 26.7% |

| 2 | PERUPLAST S.A. | 10.6% |

| 3 | COMPAÑIA GOODYEAR DEL PERU S.A. | 9.8% |

| 4 | SAN MIGUEL INDUSTRIAS PET S.A. | 8.7% |

| 5 | PERUANA DE MOLDEADOS S.A.C. | 3.3% |

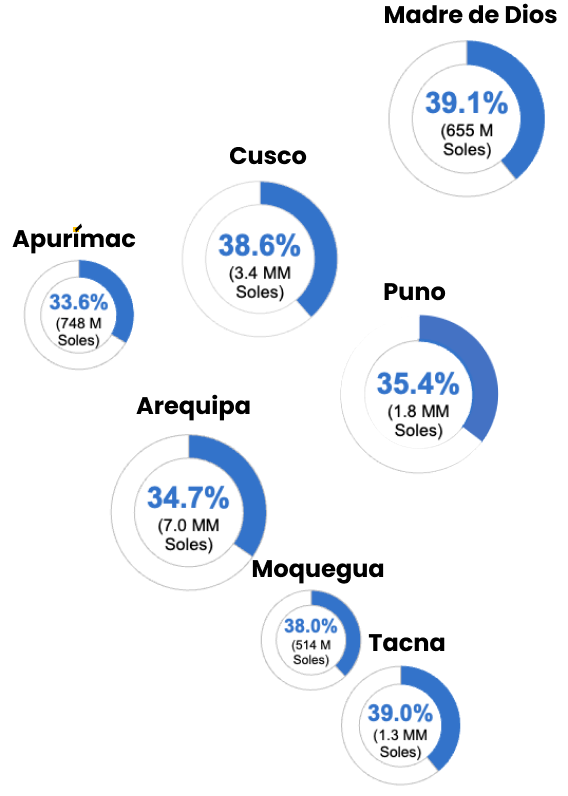

04. Access to Financing

05. The Role of Women Entrepreneurs

970 976

enterprises are led by women

99.6%

are MSE

53.3%

work in the retail sector

36.6%

are employed in the services sector; and 6.9%, in the manufacturing sector.

Between 2018 and 2022, the participation of women as managers of formal enterprises exceeded 40.0% of the total.

During this period, the number of female entrepreneurs exhibited an average annual growth of 1.7%, peaking in in 2019 with 2.39 million women entrepreneurs. However, there was a significant decline in 2020, with a decrease of 37.6% due to the impact of the pandemic